If you are 70 1/2 or older, you may be able to take advantage of a simple, tax-saving way to support KUAC!

How It Works

If you are 70 1/2 or older, and you have a traditional IRA:

- You can transfer up to $100,000 per year to charitable organizations such as KUAC Friends Group.

- The IRA charitable contribution counts toward your Required Minimum Distribution (your IRA becomes subject to this requirement at age 72).

- The amount you give is not included in your adjusted gross income (AGI), so you will not incur income taxes on this portion of your withdrawal.

Other Qualifications:

- Transfers must be made from a traditional IRA by your IRA administrator, payable to KUAC Friends Group. You cannot transfer your IRA distribution to a donor advised fund (DAF).

- You cannot receive any goods or services in exchange for your contribution.

An IRA charitable distribution is legally referred to as a Qualified Charitable Distribution (QCD), and you may have heard it referred to as an “IRA rollover.”

Why An IRA Gift?

- Giving an IRA charitable distribution is a smart way to support in-depth news and reporting and help decrease tax expenses.

- Your gift can be put to use right now to fuel more high-quality public television and radio, making a difference to you and your community.

- Your IRA charitable distribution can be made every year, so it’s a great way to make your annual gift.

Make Your IRA Charitable Distribution Today!

- Contact your IRA plan administrator or tax advisor to discuss if an IRA gift is right for you or to make your gift today!

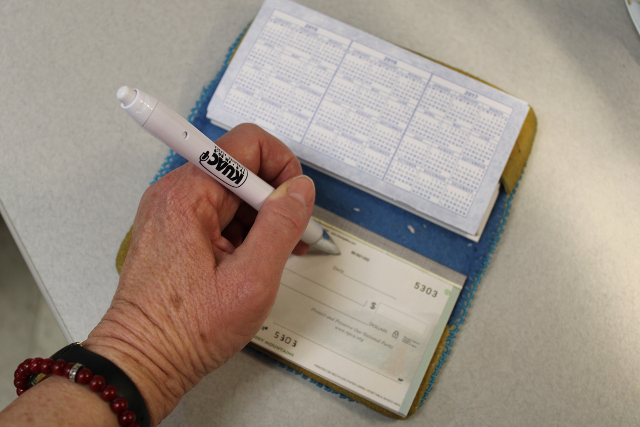

- When you’re ready to make your gift, your withdrawal check must be made payable to KUAC Friends Group.

Frequently Asked Questions

Q. What is a Required Minimum Distribution?

A. The IRS defines the Required Minimum Distribution (RMD) as “the minimum amount you must withdraw from your [IRA] each year”. Your retirement accounts become subject to RMDs the year you reach age 72, for everyone who has not reached age 70 ½ by the end of 2019. The 2019 SECURE Act increased the age at which retirees must begin taking RMDs from 70 ½ to 72 years, but it did not increase the age at which an IRA owner can take a RMD; that age remains 70 ½ years. For more information, please contact your financial advisor or IRA custodian.

Q. How should I direct my gift to KPCC?

A. KUAC Friends Group is a registered 501 (c) (3) charitable organization. The EIN / Federal Tax ID number is 47-4121401.

Q. I’ve already named KUAC Friends Group as the beneficiary of my IRA. Why should I consider giving a charitable distribution this year?

A. By making a gift this year, you can start seeing the impact of your philanthropic investment in your lifetime.

Q. I’m turning age 70½ in a few months. Can I make this gift now?

A. No. The IRS requires you to reach age 70½ by the date you make the gift.

Q. I have several retirement accounts—some are pensions and some are IRAs. Does it matter which retirement account I use?

A. Yes. According to the IRS, Qualified Charitable Distributions (QCDs) can be made only from an IRA. To determine if you are eligible to make a QCD, consult your tax advisor or retirement plan administrator.

Q. Can my gift be used as my required minimum distribution?

A. Yes. If you have not yet withdrawn your annual required minimum distribution, your IRA charitable distribution can satisfy all or part of that requirement. Contact your IRA retirement plan administrator with any questions.

Q. Is there a date I need to make my gift by to count for the current year?

A. To qualify for any tax savings in the current year, your withdrawal must be postmarked by Dec. 31. Depending on your IRA, it can take a few weeks to process withdrawals, so it is recommended to start the process at least a few weeks before the end of the year to make sure your distribution is withdrawn this year.

Q. Do I need to give my entire IRA to be eligible for the tax benefits?

A. No. You can give any amount under this provision, as long as it is $100,000 or less this year.

Q. What if my spouse and I would both like to give IRA charitable distributions. Can we give more than $100,000?

A. If your spouse is 70½ or older and has an IRA, your spouse can also give up to $100,000 from their IRA.

Have a question not listed here, or want more info? Contact Gretchen Gordon at 907.474.1891 or Gretchen.KUAC@alaska.edu.